Understanding Bitcoin from a different perspective #6

October 05/2017

The name of a Bitcoin system that increases the block size limit on a blockchain by eliminating signature data from Bitcoin transactions is Segregated Witness (SegWit). Because the method decreases the size of a transaction on a block and thus speeds up the network by pushing "witness data" to the conclusion of the transaction, the name alludes to the various transaction signatures. SegWit transactions were first implemented in August 2017 by Bitcoin Core, the most widely used protocol software. As a result, some engineers split Bitcoin into two blockchains, Bitcoin Cash was born.

October 28/2017

The Swiss have embraced Bitcoin in a big manner, with the national railway operator SSB beginning to sell Bitcoin through its network of ticket booths in October. "Up until today, there have only been a few ways to buy bitcoin in Switzerland. SBB has a robust distribution network with over 1,000 ticket machines that is open 24 hours a day, not only for purchasing tickets but also for obtaining extra services," according to SSB.

November 30/2017.

Bitcoin soared from under $1,000 on January 1, 2017 to $10,840 on December 1, 2017, making a lot of people extremely wealthy in the process. Were the gains, however, genuine? Professor John Griffin of the University of Texas was one of those who disagreed. He argues that much of it was caused by coordinated price manipulation using Tether (USDTUSD), which he says could have been carried out by only one rogue trader. He looked into millions of transactions on the Bitfinex exchange and discovered that Tether (USDTUSD) was being used to acquire Bitcoin as soon as the price dropped in order to boost it back up.

The banks were unimpressed as well. Jamie Dimon, the CEO of JP Morgan Chase (NYSE-JPM), publicly declared that any employee caught trading Bitcoin would be fired for "being dumb," labeling the currency a "fraud" that would not end well. Despite the negative headlines, JP Morgan (NYSE-JPM) purchased approximately $3 million in XBT shares (exchange-traded notes that track the price of Bitcoin) in September 2017, making it one of the more active banks in the crypto market. 📢📢📢📢Do as they do, not as they say. Follow the money💲💲💰💰.

December 18/2017

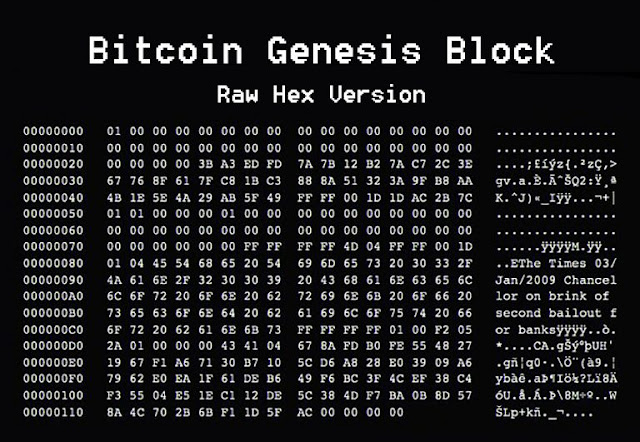

The concept of decentralized finance was 'officially' launched by Bitcoin in 2009 as the first peer-to-peer digital currency, but many consider the launch of MakerDAO to be the real turning point, as it marked the beginning of financial apps that did more than just send money from one place to another. MakerDAO was the first of many Ethereum-based protocols that allowed anyone to take out a loan without relying on a centralized institution such as a bank by pegging cryptocurrency to the value of a dollar and allowing anyone to utilize digital assets as collateral. Only four years later, in 2021, there were over 200 Defi applications available, ranging from basic loans to the creation of synthetic assets.

December 28/2017

South Korea, which has the world's third-largest cryptocurrency market, has hinted that it may follow China's lead and shut down cryptocurrency exchanges, describing the industry as "irrationally overheated." The change is unpopular, and by the end of the year, the price has dropped to roughly $12,000.

Traditional banks, on the other hand, are becoming concerned about Bitcoin. In January 2018, Agustn Carstens, the head of the Bank of International Settlements (which represents the world's central banks), described Bitcoin as a Ponzi scheme that jeopardized global financial stability. He stated, "There is a compelling case for policy involvement." "Appropriate authorities must be prepared to act in order to educate and safeguard investors and consumers." Oh, and don't forget, there's only 20% left! A solid 80% of Bitcoin had previously been mined as of January 2018.

March 06/2018

After such a spectacular December, there were great expectations for Bitcoin in 2018, but the atmosphere changed after the currency lost nearly $3,500 in early March. Some speculated that the rapid price reduction was the result of a bubble that would eventually burst. However, there were many who linked it to the 1929 Wall Street Crash. Was the rally merely a blip on the radar before everything came crashing down.Even Mr. Bill Gates, who was optimistic about cryptocurrency in 2014, has altered his mind, saying it is causing fatalities in a "pretty direct way" because to its links to terrorism funding and money laundering.

March 26/2018

Prices sink 3.60% after Twitter announces a ban on crypto adverts.Joining tech giants Google and Facebook, Twitter announced that it would ban advertising for cryptocurrencies in an effort to protect investors from fraud. Prices lost over 10% on January 30 after Facebook banned all crypto ads to prevent the spread of financial products and services “frequently associated with misleading or deceptive promotional practices.” It lost another 10% when Google followed suit on March 14.😢😢😢😢

Following Twitter's announcement of a ban on crypto advertisements, prices have dropped 3.60 percent. Twitter has joined Google and Facebook in banning cryptocurrency advertising in an effort to safeguard investors from fraud. Facebook banned all crypto advertisements on January 30 to prevent the spread of financial goods and services "often associated with misleading or deceptive promotional techniques." Prices dropped by almost 10%. When Google followed suit on March 14, it lost another ten percent.

Global regulators began to recognize the potential risks in Initial Coin Offerings (ICOs) and digital currency launched through fundraising events known as token sales, prompting the crackdowns. The SEC has previously increased its attempts to oversee the token sale process by issuing subpoenas to cryptofunds, including TechCrunch founder Michael Arrington's $100 million cryptofund, in March 2018. That's perfectly OK. All they need to do now is find out what they want. They need to establish rules so that we can all obey them, and the market is pleading with them to do so, according to Arrington. It wasn't just the US that took notice - in September 2017, the Chinese government outright banned all ICOs, sending prices plummeting by almost 7%.

April 12/2018

Bitcoin has made a 14 percent recovery after a drop on March 29, when prices dropped over 10% and stayed there.An increase in buying volume on the day was credited with the rally. Before the April tax deadline, Bitcoin investors were concerned about governmental crackdowns and tax-related sell-offs. The market regained some confidence when the incident passed without incident.

May23/2018

Bitcoin continues to tumble, having lost all of its gains since May. Analysts were bullish going up to Blockchain Week in New York last week, but expectations were mixed, and the price fell from $8,518.64 to $7,471.18 during the week. In the cryptocurrency community, Blockchain Week New York is a huge affair, and Bitcoin has witnessed a spike each year in the three years since it began, so it wasn't completely out of the question that it would do so again this year. Regulatory concerns were putting pressure on the entire market, not just Bitcoin. In what was dubbed "Operation Crypto-Sweep," the US and Canadian governments revealed substantial intentions to crack down on crypto investment schemes.

At least 70 investigations were already underway, adding to the SEC's efforts to prosecute a slew of Bitcoin operators for fraud. The movement began a downward spiral that lasted far into June.

June 28/2018

Customers of Lloyd's (LLOY) and Virgin Money (LSE-VMUK) in the United Kingdom are not allowed to buy Bitcoin with credit cards, and crypto advertising is prohibited by Twitter (TWTR), Google (GOOGL), and Facebook (FB). Despite the fact that they all swiftly reversed their decisions, the blanket prohibitions brought the price down below $6,000 by the end of June. A US Justice Department inquiry into cryptocurrency price manipulation isn't helping matters either.

July 27/2018

Bitcoin isn't doing so well, with the SEC rejecting yet another Winklevoss application for a Bitcoin exchange traded fund in July, pushing prices down approximately 3%.And the SEC's problems were far from over, contributing to Bitcoin's continued volatility for the rest of the year.

August 14/2018

This has been a particularly difficult month. By August 14, Bitcoin had dropped from $7,726.85 to roughly $5,880. In reality, cryptocurrencies throughout general had a bad month, losing around 70% of their value in the month. It sparked concerns about the mental health of all the traders and investors who were losing money by the bucket load as the markets went into meltdown mode, with claims of rising despair and suicides.

Written by neotrader

Comments

Post a Comment